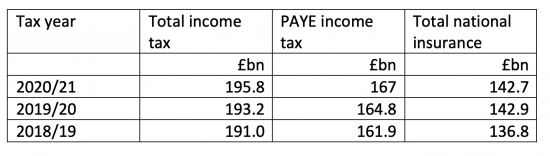

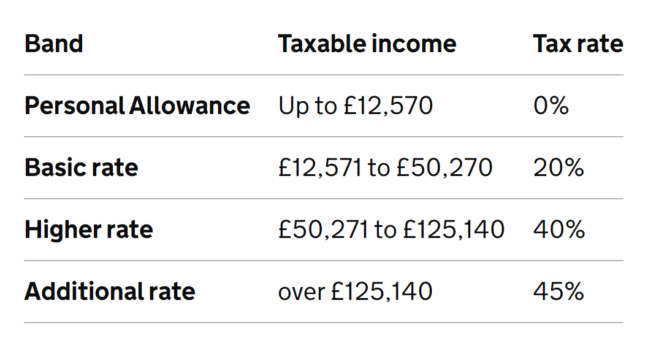

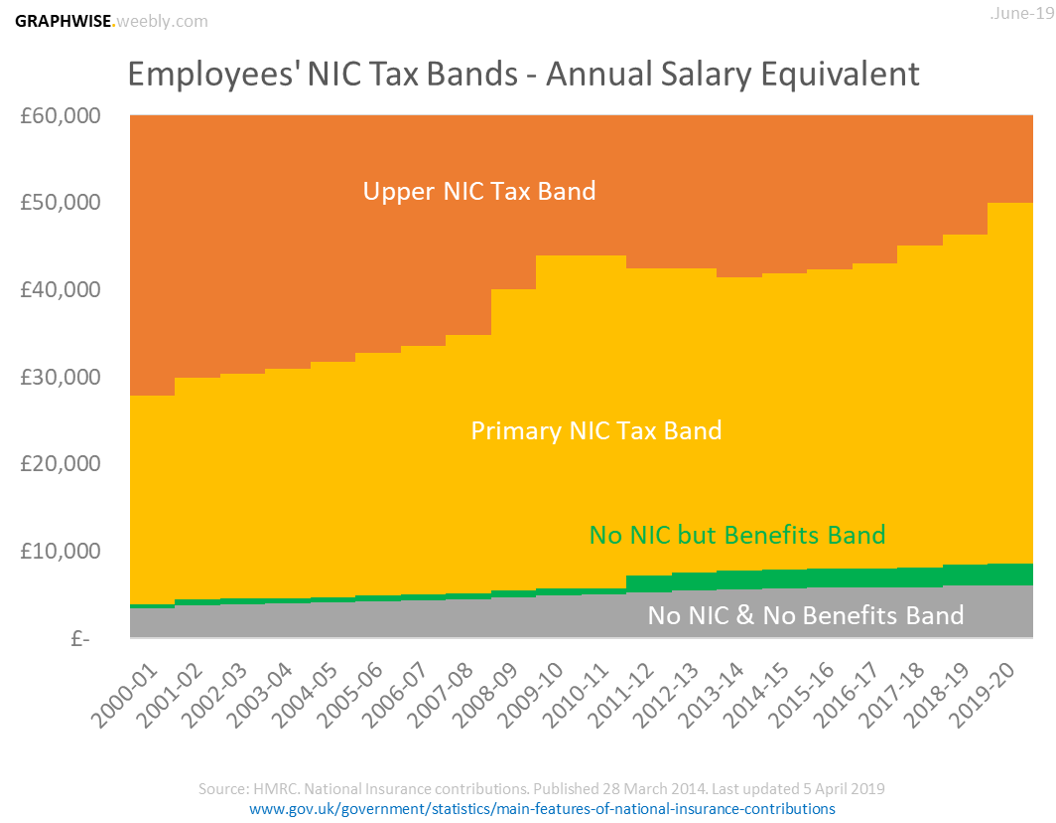

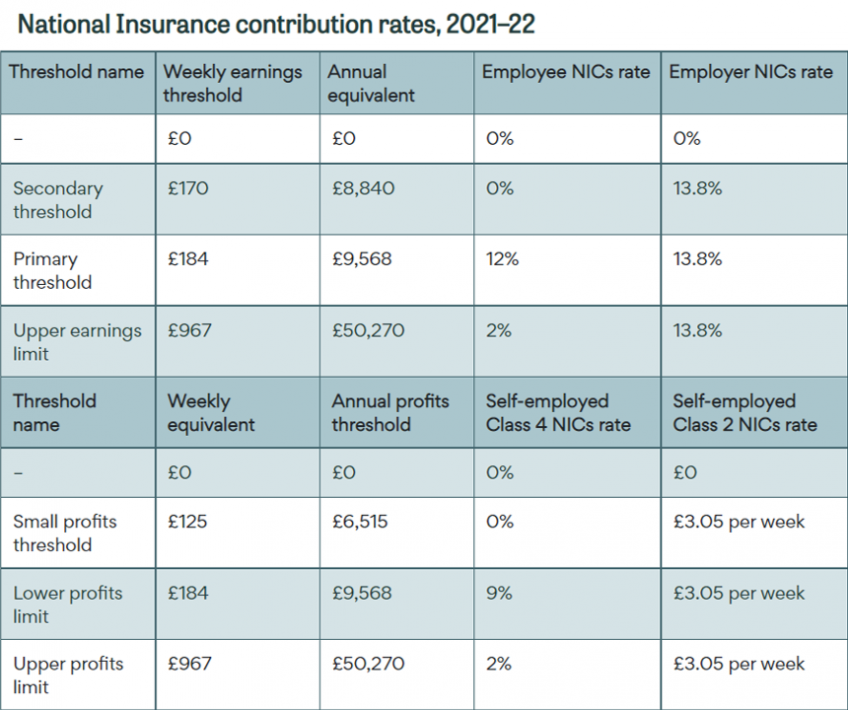

Charging national insurance at 12% on all employees, including those earning over £50,000 a year, could raise £14 billion of extra tax a year

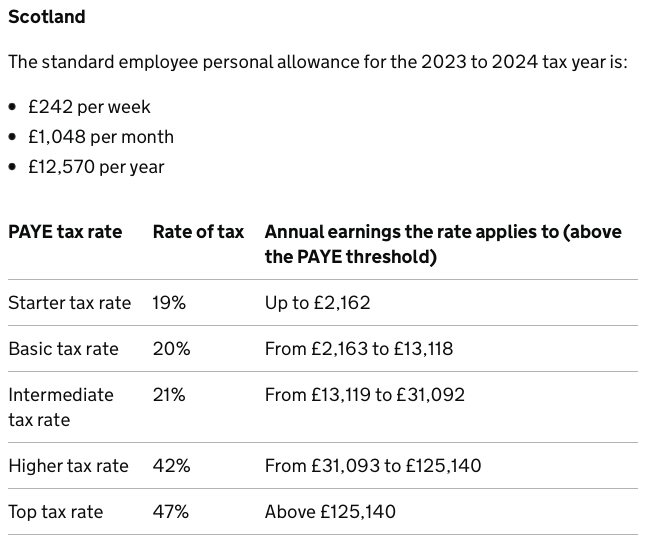

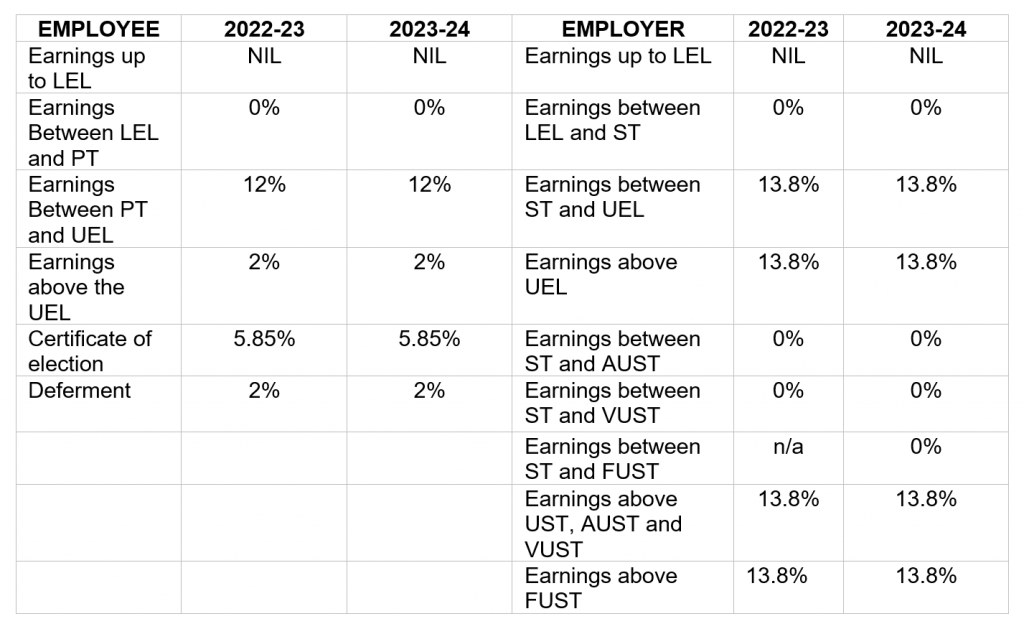

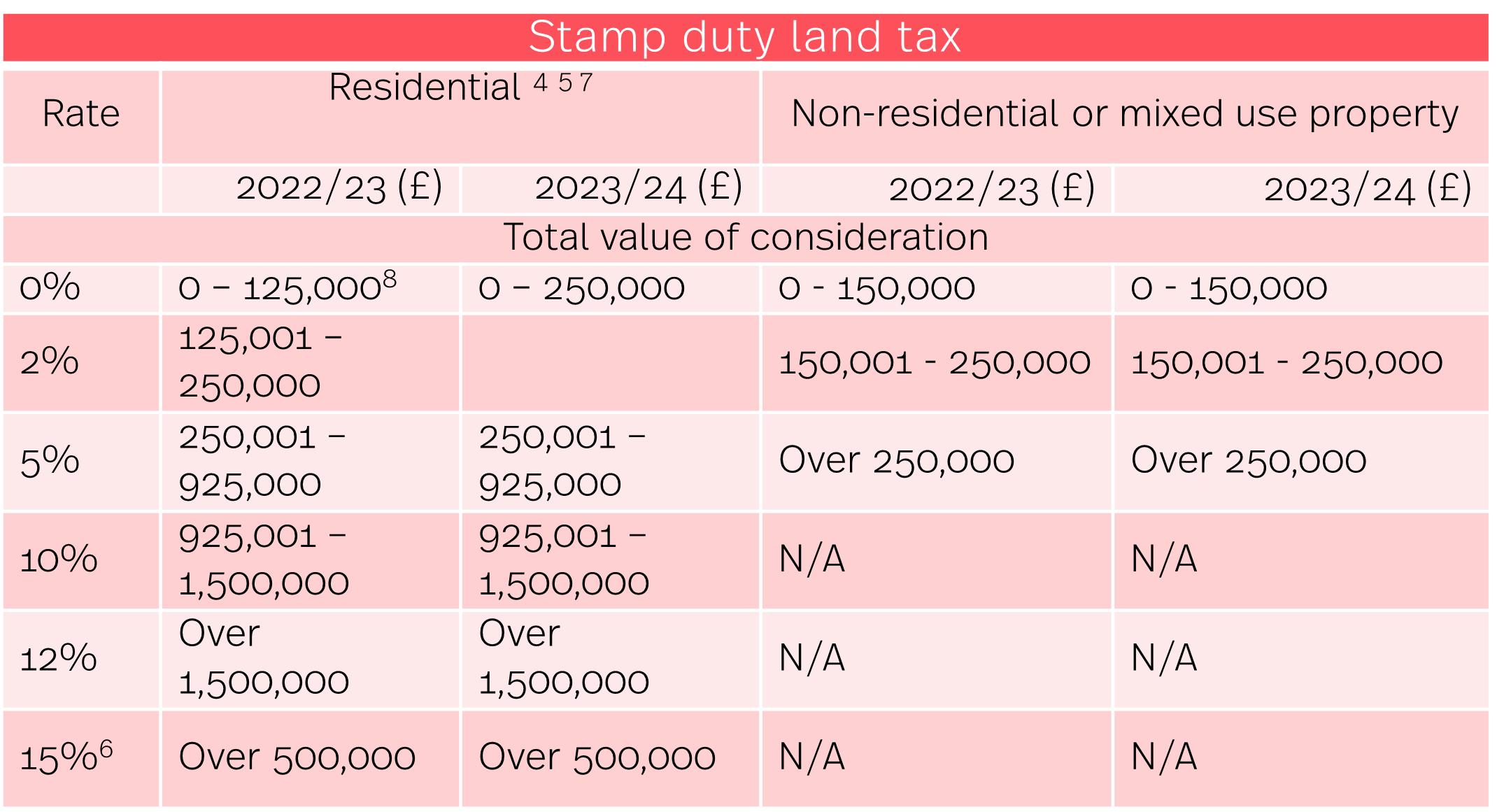

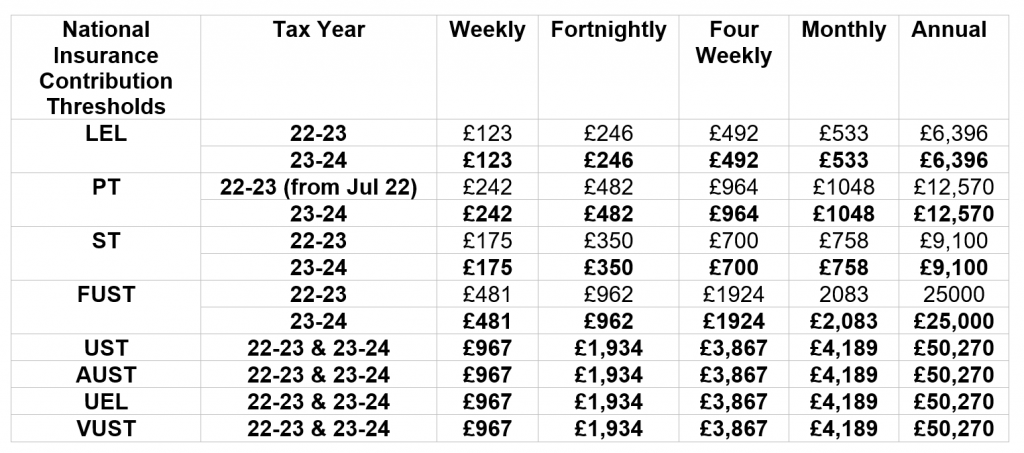

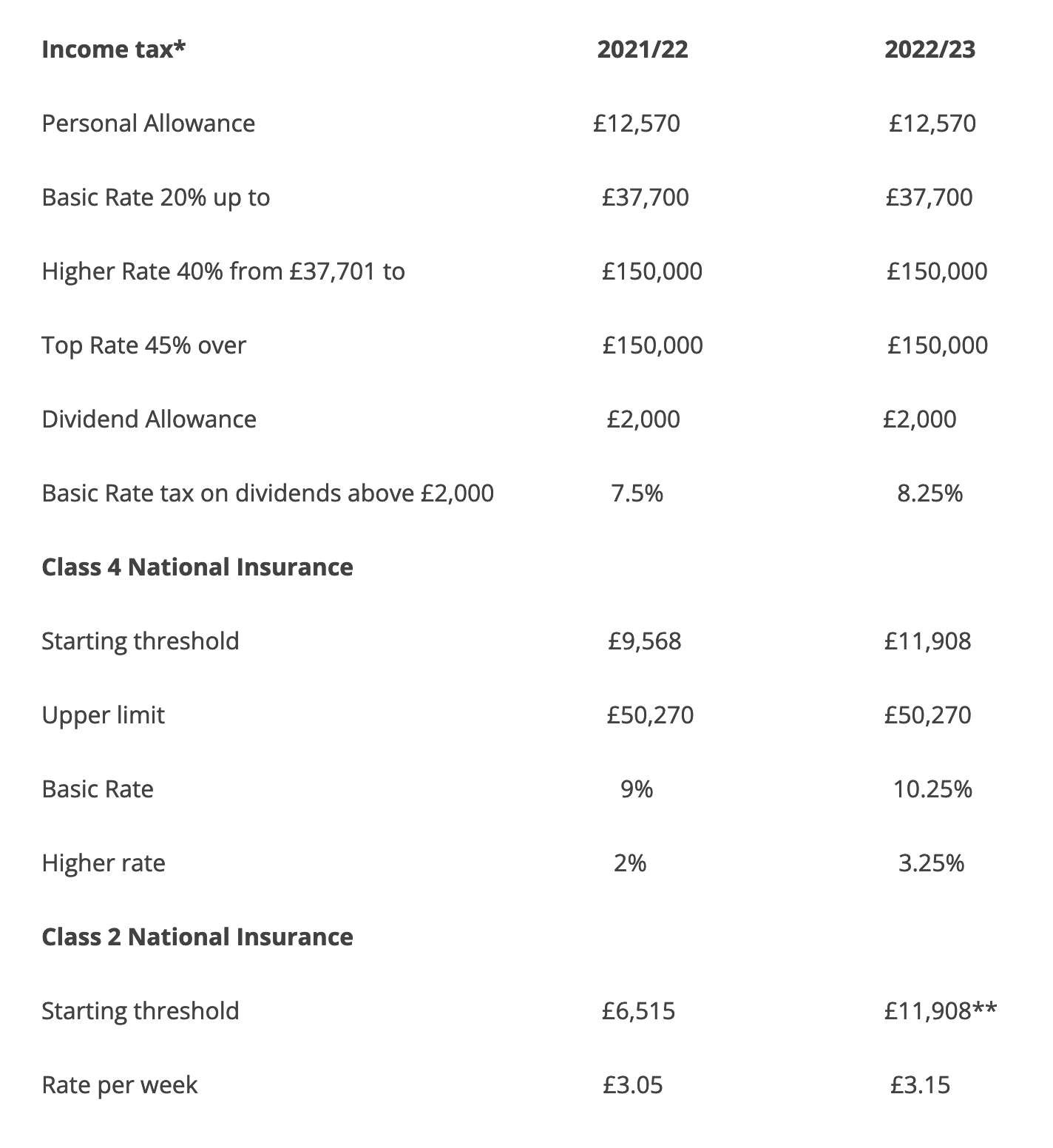

Essential Tax and national insurance rates – Red Tulips Chartered Accountants – Specialist Accountancy Services for Actors, Musicians, Creatives & Alternative Therapists